Carbon Tax: Delay Now, Pay More Later

Carbon Tax: Delay Now, Pay More Later

Indonesia’s carbon tax has been on the books since 2021, yet it remains a “paper policy”. What is preventing it from being realized in the real economy? Who will ultimately foot the bill for this delay?

At the end of 2021, Indonesia didn’t just talk about a carbon tax. We wrote it into Law 7/2021. The promise was straightforward: if GHG emission has a price, efficiency starts to pay, and low-carbon investment stops being “nice to have”.

But here we are in 2026, and for most companies the carbon tax still doesn’t show up where it should: in budgets, contracts, and monthly financial close. It remains a headline, not a habit.

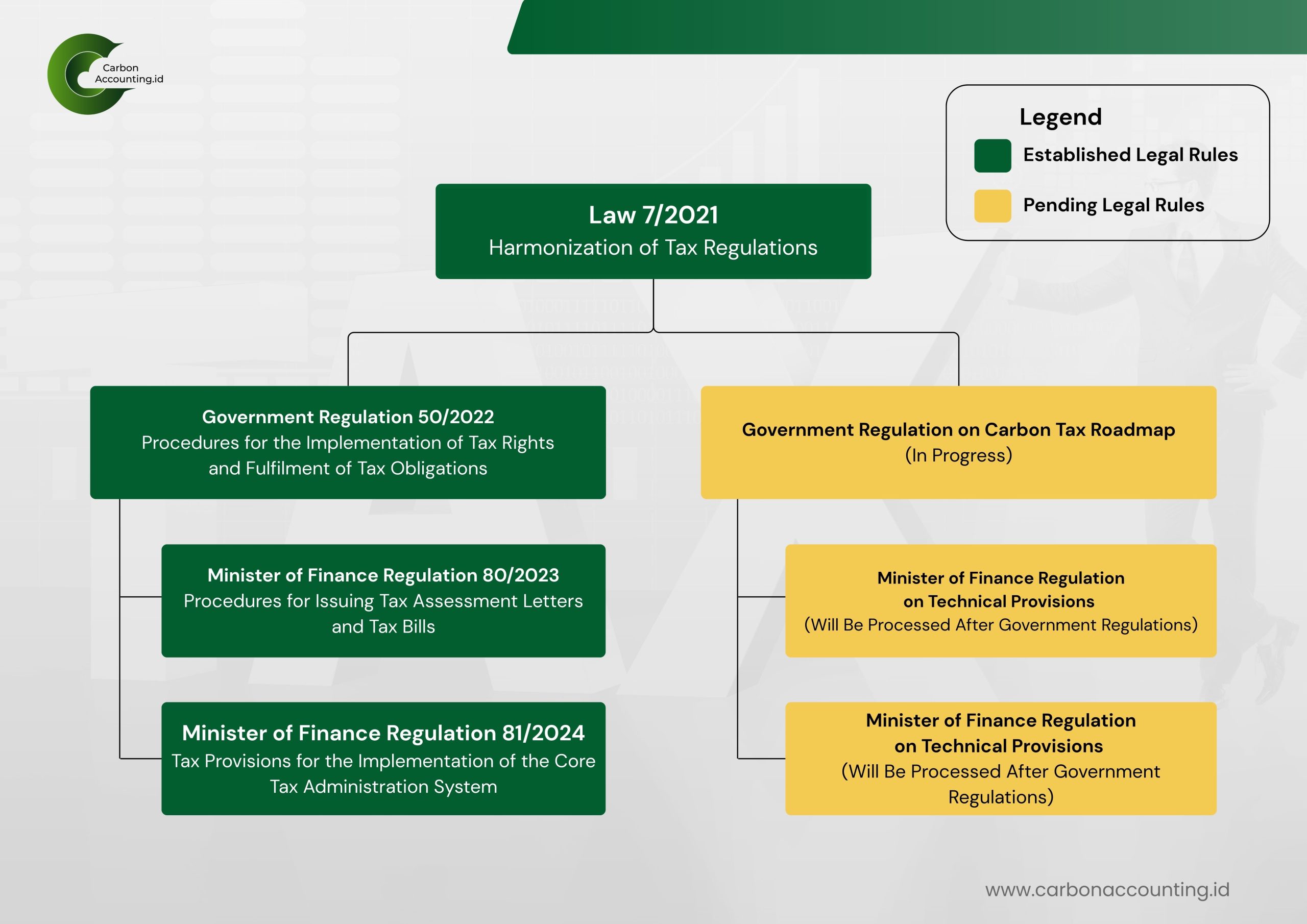

That’s what makes many executives scratch their heads. The regulatory trail looks anything but quiet: Government Regulation 50/2022, then Minister of Finance Regulation (MFR) 80/2023, then MFR 81/2024. On paper, the gears are turning. Yet on the ground, the meter still hasn’t started running. So, what’s really keeping the switch in the “off” position?

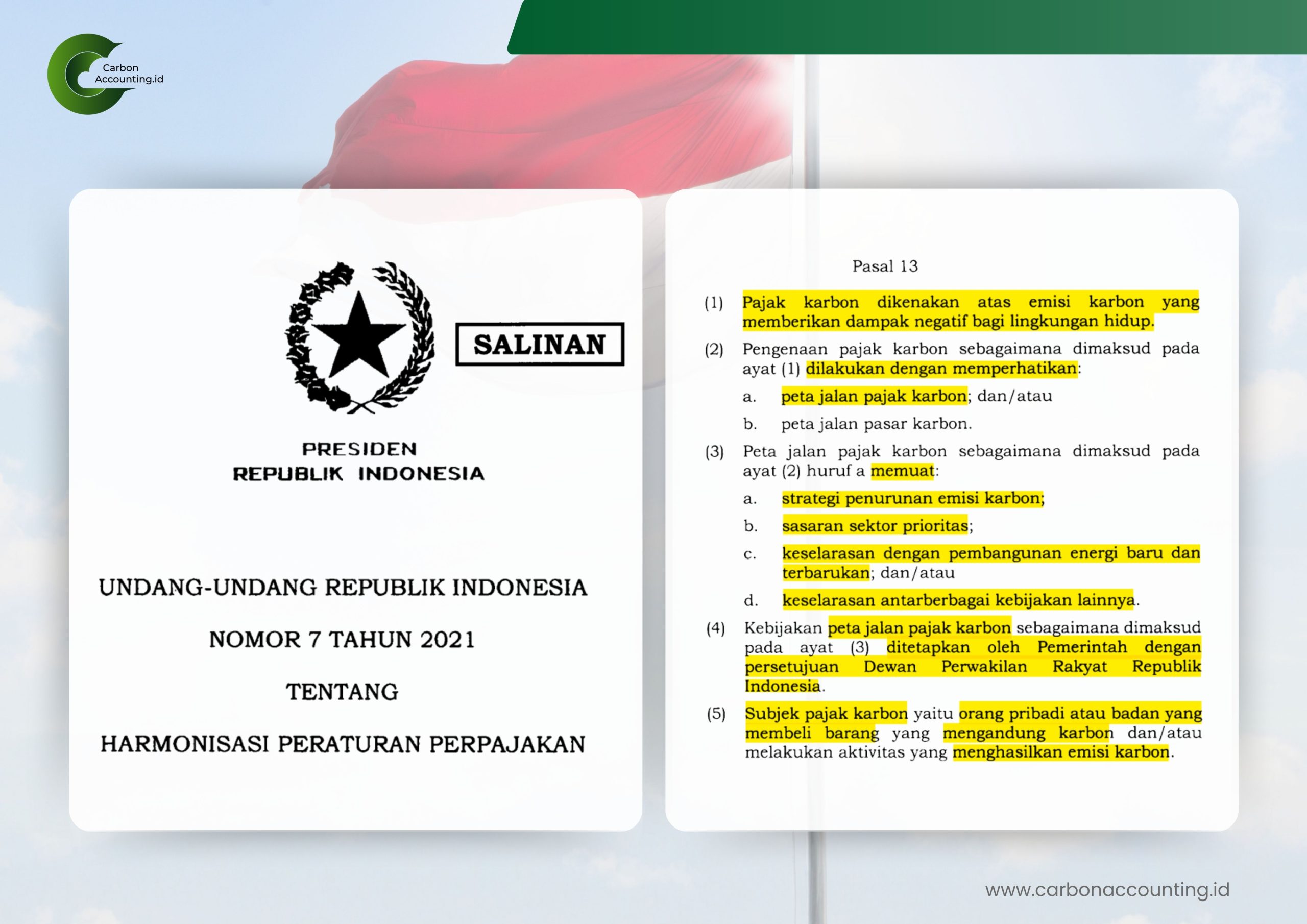

The first brake is legal. Article 13 of Law 7/2021 ties implementation to a carbon tax roadmap and/or a carbon market roadmap, one that still needs to be finalized through the government and DPR process. Without it, nobody can answer the uncomfortable basics with confidence: who starts, who follows, and what the price path will look like.

The second brake is technical, and it is heavier than it sounds. A roadmap is not a calendar. It’s an operating manual. It must translate emissions targets into priority sectors, MRV readiness, and clear links between a tax, an emissions cap, and a carbon market. If one piece moves without the others (tax without credible data, or trading without verification) trust erodes fast.

The third brake is political gravity. In the short term, a carbon tax is easy to frame as “higher costs”, “higher prices”, and “lower purchasing power”. Those fears can be real if the policy is rushed or poorly sequenced.

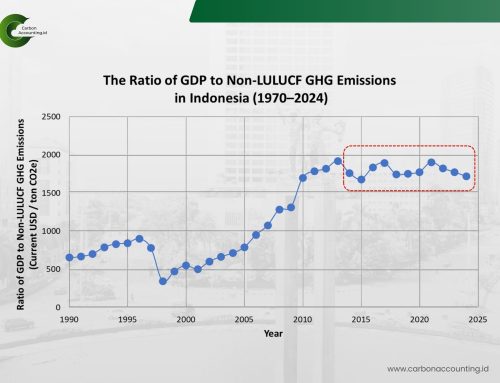

But the political debate often stops at today’s bill and ignores tomorrow’s risk. Because delay has a price too.

When domestic carbon prices stay low, border measures like the EU’s CBAM can effectively charge the difference between jurisdictions. In practice, that can mean our exports face a larger carbon bill abroad, paid far from where the emissions were produced.

Carbon pricing is also a financing tool. The longer implementation is postponed and the lower the rate remains, the smaller the fiscal space to fund transition projects, strengthen MRV systems, protect vulnerable groups, and crowd in green investment.

The choice is now in our hands: keep postponing and accept abrupt, expensive adjustments later, or publish a credible roadmap and lead with clarity.

A carbon tax is not just a tax. It’s a signal of direction. Do we steer the transition, or do we wait to be steered by it?