IFRS S2 Amendments: The New Rules of Scope 3 for Financial Institutions

IFRS S2 Amendments: The New Rules of Scope 3 for Financial Institutions

In a few years, the most unsettling climate question for financial institutions won’t be “How much does our office emit?” It will be, “How much indirect emissions are carried with our portfolio?”

The moment you start looking at portfolios instead of buildings, climate accounting stops being a side project and becomes a mirror of the real economy.

For banks, this is the loan book and securities holdings. For asset managers, it’s assets under management (AUM). For insurers, it’s investment assets. Under IFRS S2, this is where disclosure gets hard fast. The emissions that matter most are not produced by the institution itself, but by the companies it finances.

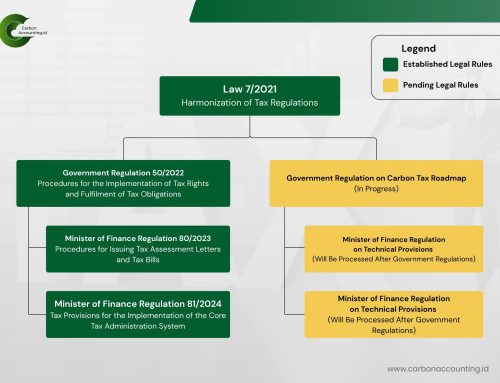

That is why, in December 2025, the ISSB issued targeted amendments to IFRS S2. Not to lower the bar, but to make implementation more workable without weakening investor usefulness. The amendments take effect for reporting periods beginning 1 January 2027 (with early adoption allowed), aligning neatly with Indonesia’s PSPK 1 and PSPK 2, also effective 1 January 2027.

The most material relief sits inside Scope 3, Category 15. Amendments to IFRS S2 now allows financial institutions to limit Category 15 to “financed emissions”, the share of a borrower’s or investee’s gross emissions that can be attributed to the institution’s loans and investments.

IFRS S2 now makes the “minimum” scope of financed emissions clearer: loans, project finance, bonds, equity investments, and undrawn loan commitments (and for asset managers, emissions linked to AUM). For many treasury teams, a practical relief stands out: emissions attributable to derivatives may be excluded, so long as the institution defines what it treats as derivatives and states what is left out.

A second change removes a common headache: the earlier expectation to use Global Industry Classification Standard (GICS) for industry classification has been replaced by a flexible approach. Institutions can use a widely used classification system that best explains transition-risk exposure, then disclose the system and the rationale.

This is not a shortcut around transparency. The relief targets one bottleneck (Category 15 scope) while obligations on climate risks, opportunities, and targets remain. Consequential amendments also align relevant SASB metrics with the updated IFRS S2, improving consistency for global investors.

For Indonesia’s financial sector, the practical path is clear: set a defensible financed-emissions boundary, build data pipelines with clients and investees, and design disclosure controls that will still hold up in 2027.