The Evolution of ESG

The Evolution of ESG

Last month, I saw a small misunderstanding grow. Two people kept saying “ESG”, nodding as if they agreed, until they didn’t. One meant ethics, community programs, and responsible business. The other meant climate risk, cost of capital, and what happens to valuations when rules tighten. Same acronym, different worlds. Nobody was wrong, the term has just stretched.

That’s the awkward truth: ESG is one label for multiple eras. It began as a language of responsibility, shifted into investor risk, then hardened into compliance with audit-ready evidence. Now it’s edging toward something harder: proving your business model creates real, measurable value for the system, not just a good-looking report.

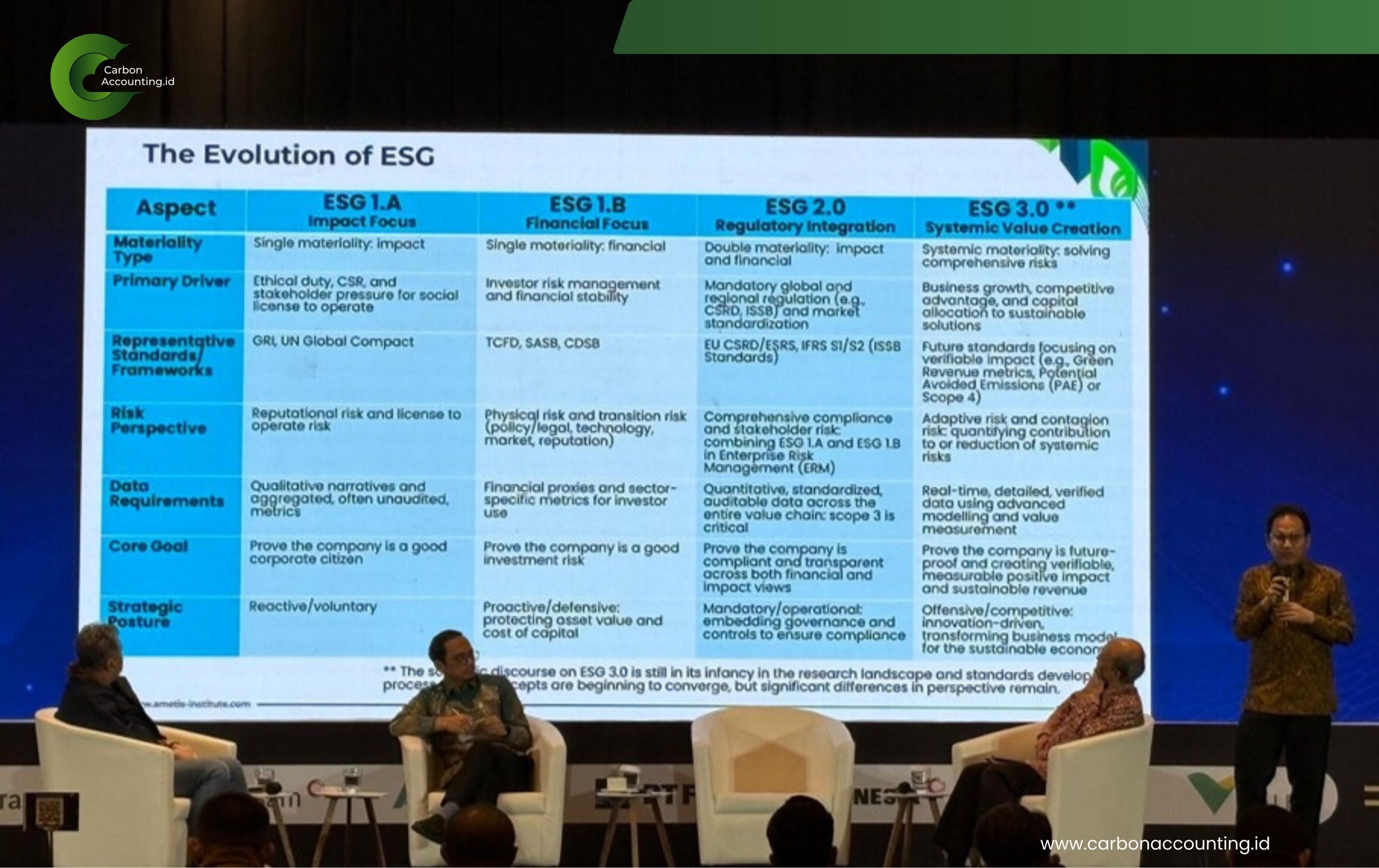

Some researchers describe this as the move from CSR toward “ESG 2.0” (Passas, 2024). At Ametis Institute, we typically map it as ESG 1.A, ESG 1.B, ESG 2.0, and ESG 3.0.

ESG 1.A is the impact era. The question is plain: “What does your company do to people and planet, and how is it governed?” The post-Rio Summit period (Agenda 21 in 1992) helped shape tools like GRI (1997) and the UN Global Compact (2000). This is where “social license to operate” became a real management concern. In ISO terms, the tone sits close to ISO 26000.

ESG 1.B changed the audience. ESG became a risk–return story for investors, lenders, and supervisors. Climate and social pressures can hit asset values, disrupt cash flows, and raise the cost of capital, so they can’t be brushed off as “reputation”. That’s why disclosure grew through CDP (2000), CDSB (2007), and then TCFD (2015), with its four pillars: governance, strategy, risk management, and metrics/targets. This framing also fits ISO 31000’s integrated view of risk.

ESG 2.0 is where ESG stops feeling optional. It’s no longer enough to say you care. You need numbers, methods, and proof someone can check. The bar rises: quantitative, standardized, assurance-ready data, especially across the value chain. The ISSB (2021) and IFRS S1/S2 pushed this toward financial-reporting discipline. Here the ISO ecosystem becomes practical: ISO 14064-1, ISO 14067, ISO 14083, and ISO 14064-3 help turn disclosure into defensible evidence.

Now we’re seeing the early shape of ESG 3.0. It’s still forming, but the questions are changing: not “What do we report?” but “What do we change?” Not only “How big are our emissions?” but “How does our model reduce systemic risk while staying profitable?” That’s why terms like green revenue, CapEx alignment, and sustainable business model innovation keep showing up. Avoided emissions (often called Scope 4) appears too-useful, but only if handled carefully, not as a shortcut.

So the practical question isn’t “Do we do ESG?” It’s “Which ESG are we being asked to do right now?” Impact accountability, investor risk language, compliance-grade reporting, or verified contribution to system outcomes?

If you’ve stopped learning because you think you’ve understood ESG, it may be time to reopen the folder and ask again: Which ESG?

#ESG #SustainabilityReporting #ISSB #IFRSS2 #ClimateRisk #CarbonAccounting