The Hidden Weakness in Corporate Climate Reports

The Hidden Weakness in Corporate Climate Reports

The question came out of nowhere. In the middle of a meeting with a senior sustainability executive at one of Indonesia’s largest companies, he suddenly asked, “What is the basis for why uncertainty analysis is important in GHG emission inventories?” The room fell silent. His team, who only moments earlier had been confidently discussing decarbonization roadmaps, froze. No one dared to answer. For us at CarbonAccounting.id, that silence was more telling than any presentation slide. It exposed a fundamental gap in the technical understanding of sustainability governance in this country.

We responded by returning to the legal foundations. We pointed to Article 10 Paragraph (4) of Presidential Regulation 98/2021, which explicitly states that uncertainty analysis is an integral part of Indonesia’s GHG emission inventory framework. The same requirement is reaffirmed in Article 13 Paragraph (4) of Presidential Regulation 110/2025, the new backbone of our national climate governance. In other words, uncertainty analysis is not an option or a “nice to have” technical detail. It is a regulatory obligation.

This incident is not an isolated case. It reflects a broader pattern: even among large and prominent companies, the technical quality of GHG inventories often remains weak. Many reports submitted to regulators and financial institutions still use incorrect emission factors or ignore tiering rules. Uncertainty analysis is absent, key category analysis is never performed, and quality control and assurance mechanisms are minimal or purely formalistic. This is happening despite the fact that these elements are clearly mandated and reinforced by law and policy.

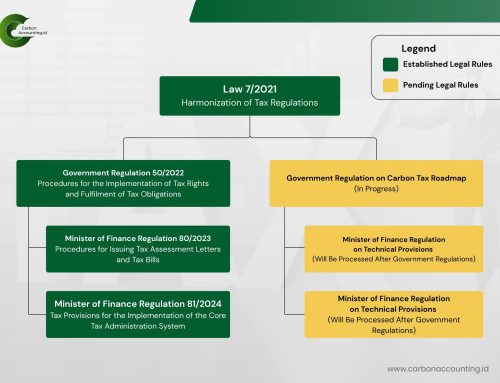

The same applies to international standards already referenced in Indonesian regulation. The IPCC Guidelines, ISO 14064-1, and global compliance frameworks such as the GHG Protocol, now embedded in financial reporting through IFRS S2 (PSPK 2), are not mere academic documents. They are the reference points for how companies must measure, report, and manage their emissions. When these standards are not properly implemented or enforced, the result is predictable: inaccurate numbers, misleading trends, and climate strategies built on shaky foundations.

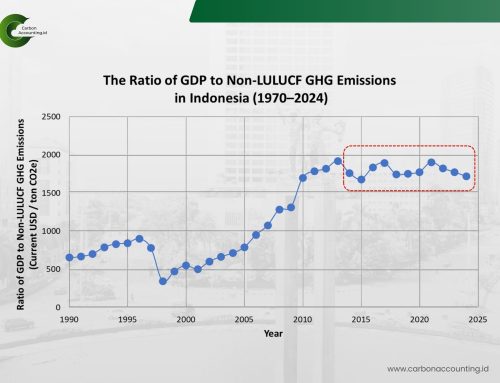

The risks are far from theoretical. If emission inventories are not robust, companies will design the wrong transition strategies, invest in the wrong projects, and misjudge where their real carbon and financial risks lie. Greenwashing practices will flourish, whether intentionally or not, exposing firms to reputational and legal consequences. Banks and investors will miscalculate risk, while “green” products and portfolios lose credibility in the eyes of regulators and global markets. Ultimately, the integrity of Indonesia’s climate transition, our claims, our targets, and our achievements will be questioned.

As a provider of sustainability products and services, CarbonAccounting.id has chosen to take the harder path: full alignment with these standards, as far as data and technology allow. The systems we develop apply emission factors according to tiering rules, integrate uncertainty analysis, perform key category analysis, and embed quality control and assurance into their architecture. We know this is not easy. It requires better data, stronger IT infrastructure, and continuous capacity-building inside organizations. But we are convinced that there is no credible climate transition without rigorous standards. Integrity in numbers is the starting point and we are committed to making that integrity a reality in Indonesia.