The Green Credit Demand Framework: A Data-Driven Playbook for Indonesia’s Transition

The Green Credit Demand Framework: A Data-Driven Playbook for Indonesia’s Transition

Indonesia’s transition to a sustainable economy will be won (or delayed) in the credit markets. The scale of investment required for clean energy, industrial retrofits, and nature-based solutions far exceeds available grant funding, pushing financing needs toward bank lending and capital markets. Yet green finance here remains thin, fragmented, and often priced like any other loan. The question, then, is not whether Indonesia needs more green credit, but how to build a mechanism that channels it efficiently, at speed, and with guardrails.

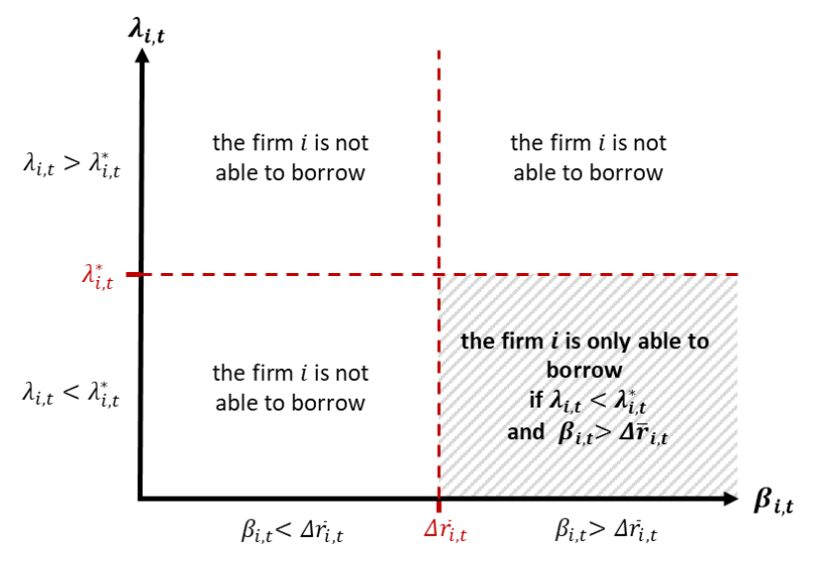

Together with colleagues at the University of Glasgow, our team recently released an open-access paper, “Understanding Credit Demand: Exploring the Impact of Leverage and Return on Borrowing”. The study proposes a simple but powerful lens: measure aggregate credit demand by observing two firm-level metrics: return on borrowing (how productively firms turn debt into profit) and leverage (how much balance-sheet space remains). By tracking the distributions of these metrics across firms, policymakers can infer where credit demand will expand or contract as interest rates and leverage covenants move, and estimate how sensitive (elastic) demand is to those policy levers.

Translated to green finance, this framework points to an actionable mechanism: a data-driven “green credit window” that adjusts two dials (lending rates and eligible leverage) based on observed conditions in priority green sectors. When the distribution of return on borrowing is healthy but firms are constrainted by covenants, regulators can widen leverage allowance for taxonomy-aligned projects. When leverage room exists but projects are marginal at prevailing rates, a temporary rate corridor can unlock bankable pipelines. In both cases, the calibration is guided by measured demand (not intuition) reducing mispricing and crowd-out risks.

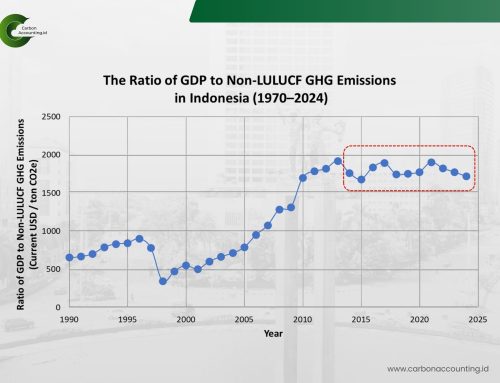

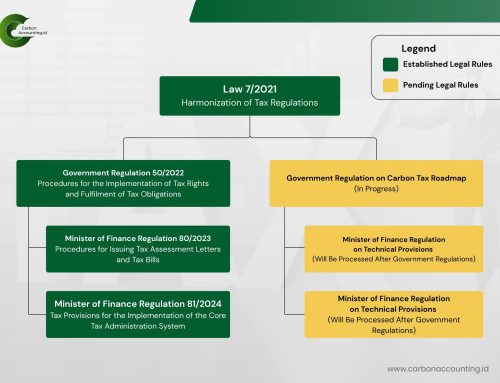

This approach also prepares Indonesia for what may come next: an oversupply of green capital driven by mandates, global investor appetite, and market momentum. Excess capital without absorption capacity breeds volatility and misallocation. Publishing a quarterly “Green Credit Demand Index” that summarizes the evolving distributions of return on borrowing and leverage in green sectors would give Bank Indonesia, OJK, and lenders a shared dashboard. With it, they can time policy support, target sectors with genuine borrowing capacity, and phase down incentives as conditions normalize, keeping the market both catalytic and disciplined.

CarbonAccounting.ID’s role is to make this operational. We build the pipelines that transform firm-level financials into sector-level credit-demand signals, and we help lenders and regulators translate those signals into rate, covenant, and risk-management settings that grow green lending responsibly. In our view, that is the effective mechanism Indonesia needs: a rules-based, measurement-first credit architecture that meets the urgency of the transition without compromising prudence.