Border Climate Policies Are Coming: What Indonesia Must Do Now

Border climate policy is reshaping global trade. In essence, it applies additional charges or documentation requirements to imported goods based on the greenhouse gas (GHG) emissions embedded in their production. While the labels differ by jurisdiction, the objective is the same: align market access with climate ambition and prevent “carbon leakage” from high-emitting production shifting across borders.

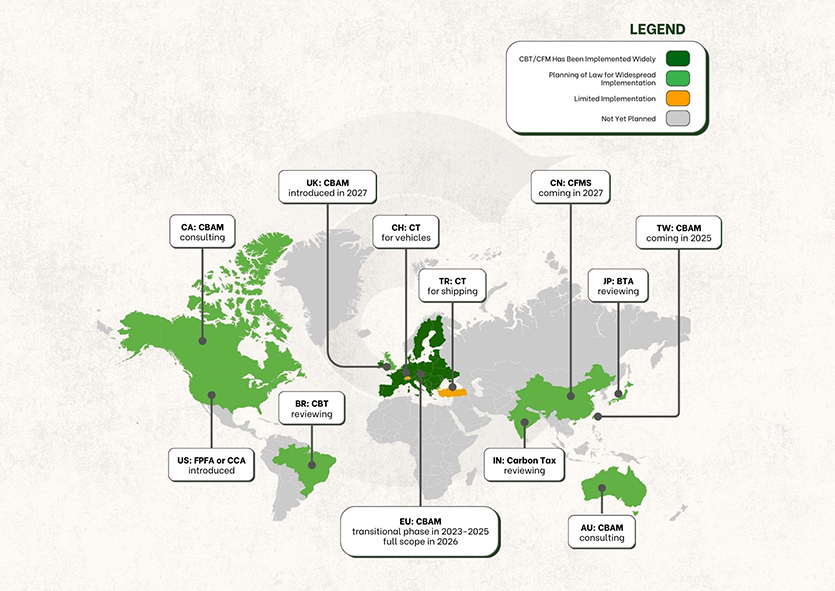

Across major economies, the policy architecture is taking clearer shape. The European Union’s Carbon Border Adjustment Mechanism (CBAM) begins charging in 2026, with the United Kingdom following in 2027. Other large markets are moving on parallel tracks under different banners, such as the United States’ proposed Foreign Pollution Fee Act (FPFA), Canada’s exploration of Border Carbon Adjustments (BCA), Japan’s planned carbon levy, Australia’s CBAM discussions, and China’s Carbon Footprint Management System (CFMS), which advances product-level footprint standards. For exporters, the signal is unambiguous: climate performance will increasingly influence border costs and access.

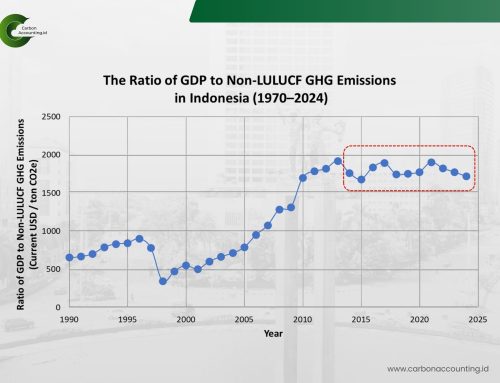

For Indonesia, the stakes are significant. If left unaddressed, these measures could erode the competitiveness of key export categories and strain economic resilience. Indonesian businesses therefore need to accelerate climate compliance, strengthening emissions measurement, verification, and reporting (MRV), aligning with partner-country requirements, and integrating low-carbon practices into operations and supply chains. In the early phases, mining and energy-intensive commodity value chains are among the most exposed.

With that urgency in mind, CarbonAccounting.id contributed to a seminar hosted by the Defense University in mid-December 2024, “Strategies for Facing Climate Compliance Demands in the Mining Sector.” Our researcher, Dr. Rolan M. Dahlan, ST, MBA, outlined the evolving landscape of border-climate measures and set out practical anticipatory strategies for mining companies, from establishing auditable GHG baselines and supplier data pipelines to scenario-testing export destinations’ rules and price signals.

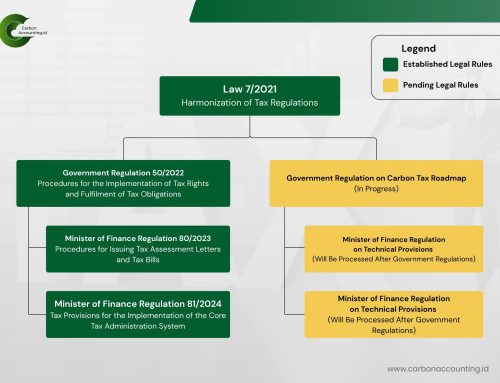

The details of border climate policy are dynamic and jurisdiction-specific, and effective responses require the right tools. At CarbonAccounting.id, we are developing systems and technology to help Indonesian businesses calculate embedded emissions, manage documentation, and align with destination-market standards. By pairing rigorous measurement with actionable guidance, we aim to support Indonesia’s exporters in maintaining market access and strengthening national export resilience as border climate policies mature.

Border Climate Policies Are Coming: What Indonesia Must Do Now

Border climate policy is reshaping global trade. In essence, it applies additional charges or documentation requirements to imported goods based on the greenhouse gas (GHG) emissions embedded in their production. While the labels differ by jurisdiction, the objective is the same: align market access with climate ambition and prevent “carbon leakage” from high-emitting production shifting across borders.

Across major economies, the policy architecture is taking clearer shape. The European Union’s Carbon Border Adjustment Mechanism (CBAM) begins charging in 2026, with the United Kingdom following in 2027. Other large markets are moving on parallel tracks under different banners, such as the United States’ proposed Foreign Pollution Fee Act (FPFA), Canada’s exploration of Border Carbon Adjustments (BCA), Japan’s planned carbon levy, Australia’s CBAM discussions, and China’s Carbon Footprint Management System (CFMS), which advances product-level footprint standards. For exporters, the signal is unambiguous: climate performance will increasingly influence border costs and access.

For Indonesia, the stakes are significant. If left unaddressed, these measures could erode the competitiveness of key export categories and strain economic resilience. Indonesian businesses therefore need to accelerate climate compliance, strengthening emissions measurement, verification, and reporting (MRV), aligning with partner-country requirements, and integrating low-carbon practices into operations and supply chains. In the early phases, mining and energy-intensive commodity value chains are among the most exposed.

With that urgency in mind, CarbonAccounting.id contributed to a seminar hosted by the Defense University in mid-December 2024, “Strategies for Facing Climate Compliance Demands in the Mining Sector.” Our researcher, Dr. Rolan M. Dahlan, ST, MBA, outlined the evolving landscape of border-climate measures and set out practical anticipatory strategies for mining companies, from establishing auditable GHG baselines and supplier data pipelines to scenario-testing export destinations’ rules and price signals.

The details of border climate policy are dynamic and jurisdiction-specific, and effective responses require the right tools. At CarbonAccounting.id, we are developing systems and technology to help Indonesian businesses calculate embedded emissions, manage documentation, and align with destination-market standards. By pairing rigorous measurement with actionable guidance, we aim to support Indonesia’s exporters in maintaining market access and strengthening national export resilience as border climate policies mature.