TKBI Version 3: How Indonesia’s Green Taxonomy Will Reshape Business and Finance

TKBI Version 3: How Indonesia’s Green Taxonomy Will Reshape Business and Finance

The Indonesian Sustainable Finance Taxonomy (Taksonomi Keuangan Berkelanjutan Indonesia/TKBI) is quietly becoming one of the most important “filters” for capital allocation in Indonesia. Developed by the Financial Services Authority (OJK), TKBI classifies economic activities as “Green,” “Transition,” or “Unclassified,” and that simple label will increasingly influence how easily companies access funding, at what cost, and how they are perceived by banks, investors, and global value chains. In practice, TKBI is no longer just a technical document, it is a new language for talking about which parts of the economy are aligned with climate targets and sustainable development, and which are not.

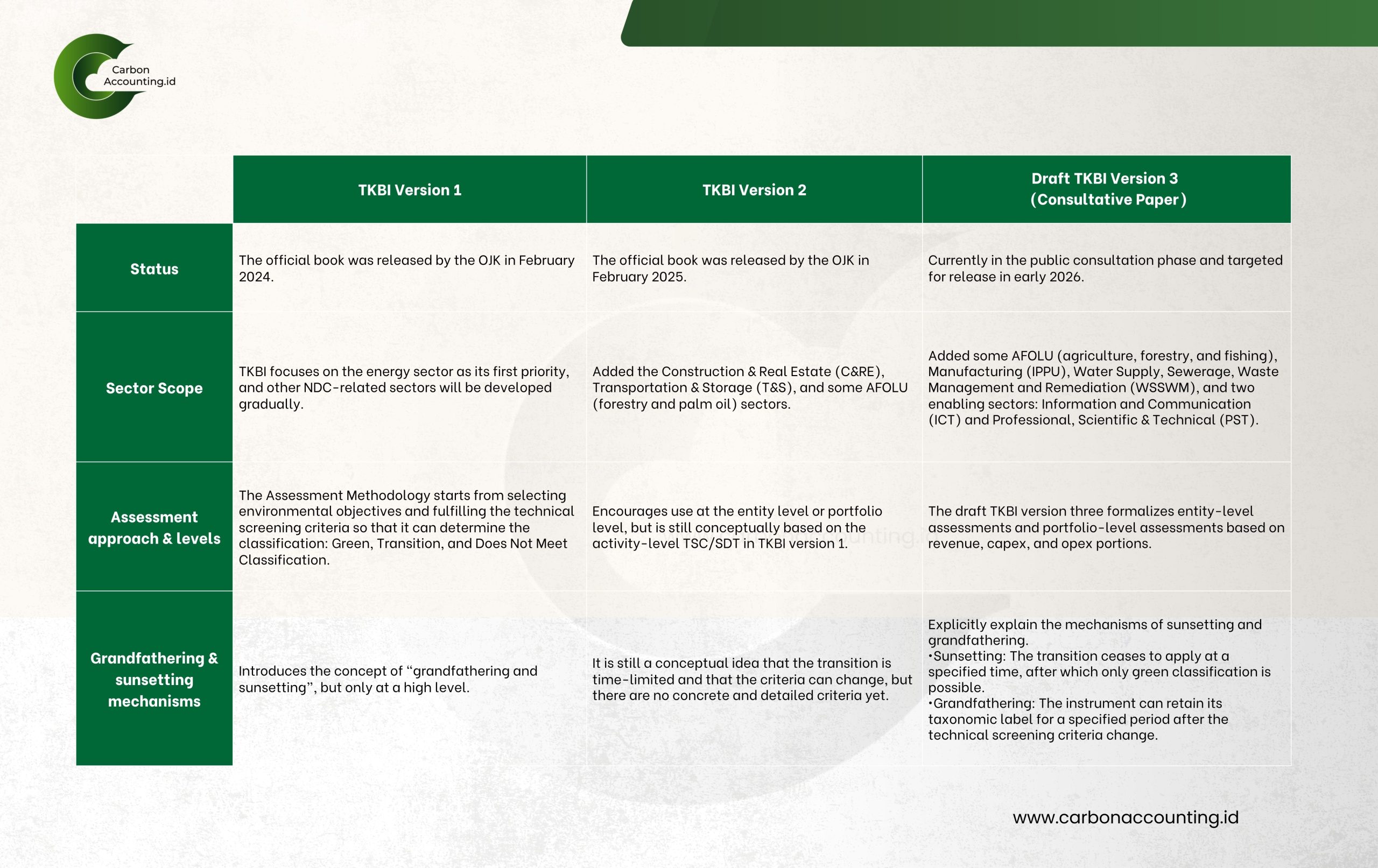

From CarbonAccounting.ID’s perspective, the evolution from TKBI Version 1 to Version 2 and now the consultation draft of Version 3 marks a steady tightening of expectations. Version 1 focused primarily on the energy sector, with a project-by-project screening approach. Version 2 expanded the scope to include construction and real estate, transportation and storage, and segments of AFOLU such as forestry and palm oil. The consultation draft of Version 3 goes much further. It adds broader AFOLU categories (agriculture, forestry, and fishing), manufacturing activities linked to industrial processes and product use (IPPU), water supply, sewerage, waste management and remediation (WSSWM), and two enabling sectors: information and communication technology (ICT) and professional, scientific, and technical services (PST).

Substantively, Version 3 reshapes the playing field in at least three ways. First, it exposes more business models to taxonomic scrutiny, meaning more companies will have activities explicitly labelled Green, Transition, or Unclassified. Second, it formalizes entity-level and portfolio-level assessments based on the mix of revenue, capital expenditure, and operating expenditure, moving beyond the idea that a single “green project” can redeem an otherwise high-emission balance sheet. Third, it operationalizes sunsetting and grandfathering mechanisms: transition criteria are explicitly time-limited, and financial instruments can retain their labels for a defined period even after technical criteria change.

For businesses, the most tangible impact is on risk and refinancing. A narrower and time-bound “Transition” category means that assets and activities currently classified as transitional may lose their status after a given date, at which point only “Green” classifications remain available. Companies that do not plan ahead may find themselves sitting on assets that are more difficult to refinance, face higher funding costs, or even become stranded in the eyes of lenders and investors. At the same time, the recognition of ICT and PST as enabling sectors opens space for new business models (digital platforms, data services, research, and technical advisory) that help others meet TKBI criteria and can themselves be labelled as supporting the green transition.

TKBI Version 3 also raises the bar on data and governance. Compliance is not just about reducing emissions on paper. It requires demonstrating alignment with environmental objectives, meeting Do No Significant Harm (DNSH) thresholds, and fulfilling social safeguards. That, in turn, demands audit-ready data, robust measurement, reporting, and verification (MRV), and integration with national and global systems such as Indonesia’s National Registry System (SRN) and IFRS S1–S2 for sustainability-related financial disclosures. Companies that cannot evidence their claims with credible data will struggle to convince banks, investors, and regulators that their activities genuinely qualify as green or transitional.

In our view at CarbonAccounting.ID, businesses should not wait for the final text of TKBI Version 3 before acting. There are at least five strategic steps that can be taken now: (1) map all company activities against TKBI categories; (2) develop a clear transition and decarbonization plan, including timelines aligned with potential sunset dates; (3) evaluate and deliberately shape the future mix of revenue, capex, and opex to improve the share of green activities; (4) build audit-ready data governance integrated with SRN and IFRS S1–S2; and (5) leverage digital tools, research, and ongoing technical consultation to keep pace with evolving criteria. Companies that move early will not only reduce regulatory and financing risk, but also position themselves as credible players in Indonesia’s.