Perpres 110/2025: Six Strategic Shifts Businesses Must Anticipate in Indonesia’s Carbon Governance

Perpres 110/2025: Six Strategic Shifts Businesses Must Anticipate in Indonesia’s Carbon Governance

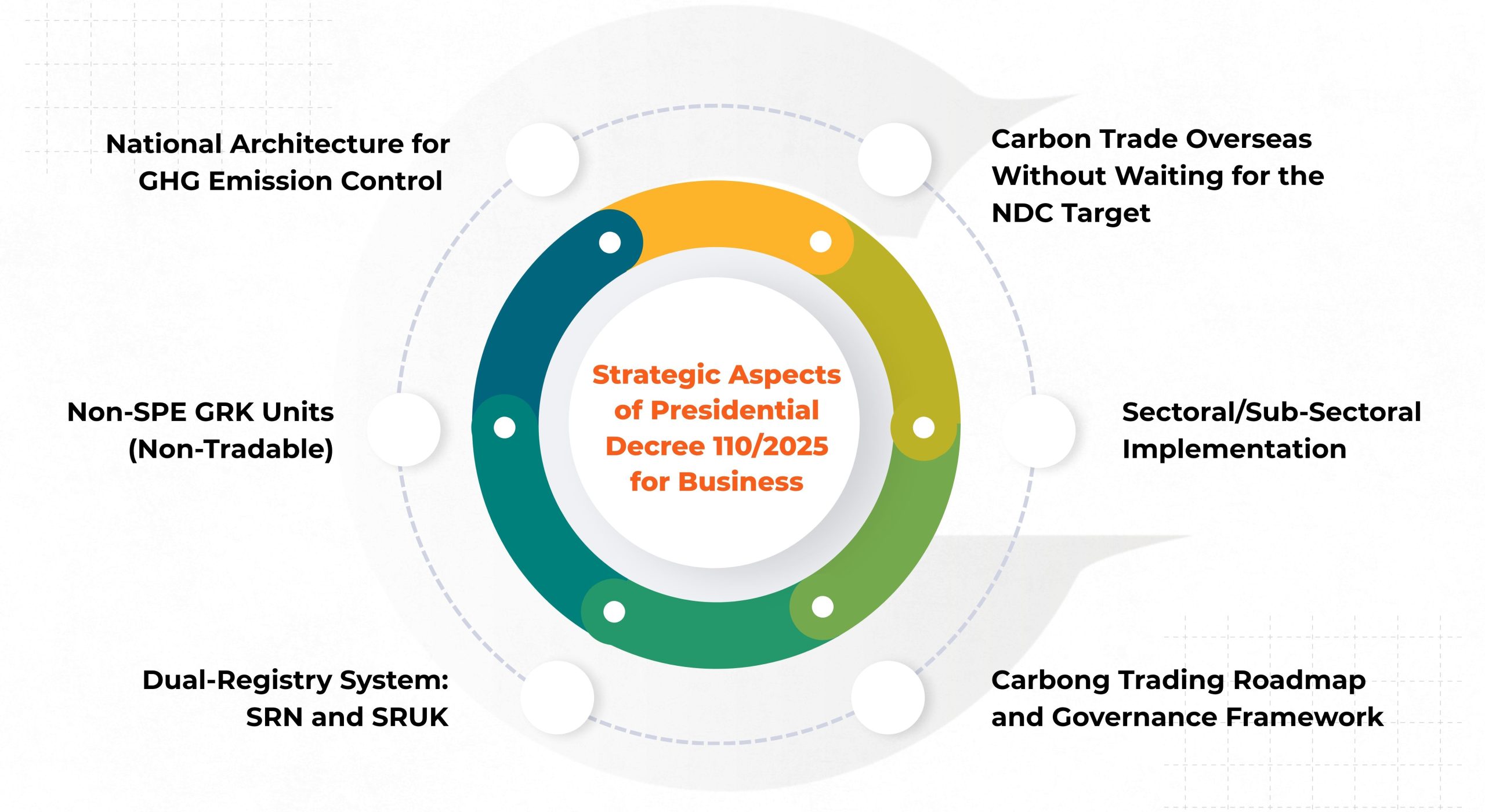

On 10 October 2025, the Indonesian government issued Presidential Regulation (Perpres) 110/2025, officially revoking and replacing Perpres 98/2021 on the Carbon Economic Value (NEK). From our perspective at CarbonAccounting.ID, this is not a cosmetic change. For businesses, Perpres 110/2025 reshapes the architecture of carbon governance in Indonesia: how emissions are controlled, how carbon units are created and traded, and how they are recorded and valued. The key question for corporate leaders is no longer just “how do we comply?” but “how do we position our business in this new carbon governance landscape?”

The first major shift is that Perpres 110/2025 no longer focuses solely on achieving the Nationally Determined Contribution (NDC) target, but on building a national architecture for GHG emission control (Articles 2-6). The regulation explicitly introduces the logic of cross-sectoral carbon budget management, with emissions allocations at the level of sectors and subsectors. For businesses, this means decarbonization can no longer be seen as an isolated CSR or efficiency program. Carbon allocation by sector will increasingly shape room for growth, asset planning, and investment, so companies must start integrating “carbon budgets” into their corporate plans, risk management frameworks, and long-term capital expenditure decisions.

The second strategic change is the treatment of international carbon trade. Under Perpres 98/2021 (Article 49), foreign carbon trading was framed in a way that should not reduce the achievement of the NDC. Perpres 110/2025 (Articles 58 and 68) takes a bolder stance: carbon trading can proceed without waiting for the NDC target to be achieved. This opens the door for companies to actively pursue revenue from carbon credit exports, especially for high-quality mitigation projects. However, it comes with a higher level of technical and legal complexity: businesses must pay careful attention to authorization procedures and corresponding adjustment (CA) rules so that exported credits do not unintentionally undermine Indonesia’s NDC accounting or create double counting risks in contracts.

Third, while the types of NEK instruments remain the same (carbon trading, result-based payments, and carbon levies) Perpres 110/2025 (Article 55) explicitly ties their implementation to Sectors and Subsectors. This is more than a terminological tweak, it signals a move toward sector-specific instrument design and implementation. For companies, this means the NEK scheme they design (whether internal carbon pricing, offset projects, or participation in cap-and-trade) must align with the instrument architecture in their sector/subsector. Misalignment could result in projects that look attractive on paper but turn out ineligible, under-valued, or non-compliant when sectoral rules are finalized.

Fourth, Perpres 110/2025 links carbon trading (whether via an exchange or over-the-counter) to a national carbon trading roadmap and governance framework (Article 58), which are explicitly multi-sectoral and connected to international carbon markets (Article 69). This means businesses can no longer treat participation in the carbon market as a purely bilateral or opportunistic transaction. They need a clear strategic position: Will they primarily be compliance entities under a cap-and-trade scheme, net buyers, net sellers, or project developers supplying offsets? Their choices must align with the national carbon trading roadmap, evolving caps, and Indonesia’s linkage strategy to global markets.

The fifth transformation is in data architecture. Previously, businesses were familiar with reporting to the National Registry System (SRN). Now Perpres 110/2025 establishes a dual-registry system: the SRN for recording climate actions and underlying data, and the Carbon Unit Registry System (SRUK) for recording carbon units and transactions (Articles 59 and 65). For companies, this split is not merely administrative. It requires a more sophisticated internal data system that can distinguish between activity/emission data (feeding SRN) and unit-level information (feeding SRUK). It also demands robust “carbon unit governance”: tracking issuance, ownership, transfer, retirement, and use of units in a way that is auditable and consistent with both registries.

Sixth, Perpres 110/2025 introduces an important concept for corporate accounting and valuation: Non-SPE GRK (Article 75). These are emission reduction units that are recorded for reporting, rating, or other purposes but are not tradable as carbon units. This means companies must divide their carbon inventories into at least two categories: SPE GRK (tradable, eligible units) and Non-SPE GRK (non-tradable, informational units). This categorization will affect how companies design mitigation projects, how they recognize value in their financial and sustainability reporting, how they structure contracts, and how they communicate climate performance to investors and rating agencies.

Perpres 110/2025 is a clear message that Indonesia is moving from a “pilot phase” of NEK toward a more mature, integrated carbon governance regime. Businesses that treat this regulation as a simple administrative update will miss crucial strategic opportunities and expose themselves to compliance, contractual, and valuation risks. The winning strategy now is to build integrated GHG data pipelines, clarify carbon unit governance, revisit carbon contracts, and embed carbon budget thinking into core business planning. We stand ready to support companies through this transition, from interpreting the regulation to designing actionable roadmaps that are both compliant and value-creating.