Making Risk Legible: Why CarbonAccounting.ID Invest in TCFD Expertise

Making Risk Legible: Why CarbonAccounting.ID Invest in TCFD Expertise

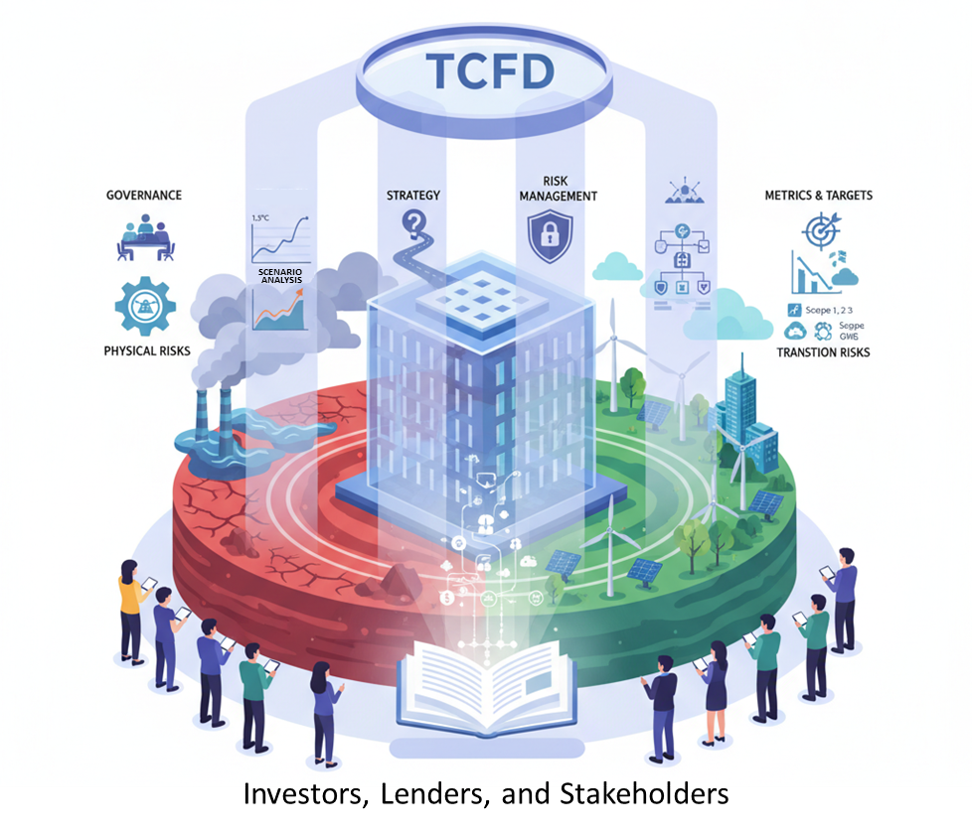

Carbon risk is no longer a footnote. It is a balance-sheet reality. The Task Force on Climate-related Financial Disclosures (TCFD), convened by the Financial Stability Board at the G20’s request, set out to make those risks legible. Its framework is deceptively simple: governance, strategy, risk management, and metrics and targets. Together, they create a common language for how climate risk moves through a company’s operations and into its cash flows. Investors have learned to read it. Boards have learned to answer to it.

Though the TCFD completed its mandate and wound down at the end of 2023, its imprint has only deepened. Regulators from London to Brussels to Washington have drawn on the framework, and the International Sustainability Standards Board (ISSB) anchored IFRS S2 squarely in TCFD’s architecture. For large companies, disclosure is shifting from encouragement to expectation. In practice, this means clearer board oversight of climate, more decision-useful scenario analysis, and comparable targets that can be tested against performance.

At CarbonAccounting.ID, we view this not as a compliance chore but as an operating system for credible transition plans. Our clients, banks, miners, transport operators, hospitals, etc., need disclosures that withstand scrutiny from lenders and credit committees, not just glossy reports. TCFD training equips our teams to translate physical and transition risks into financial terms: margin pressure from energy costs, capex for efficiency and low-carbon technologies, stranded-asset exposure, and the cost of capital that increasingly hinges on climate governance.

That is why we have invested in people before platforms. Several of our experts have completed the comprehensive TCFD training and examination delivered by the Carbon Disclosure Project (CDP) and the Climate Disclosure Standards Board (CDSB), others are partway through the same rigorous track. The coursework is not light from scenario design, metrics selection, internal controls, to assurance readiness. But it is precisely the discipline our clients need as they align with IFRS S2 and related national rules.

We will continue to build capability the way TCFD intended, by connecting climate literacy to financial decision-making. For us, that means tighter integration between emissions data and enterprise risk, clearer narratives linking strategy to capital allocation, and targets that are measurable, time-bound, and auditable. The market is asking sharper questions. With a TCFD-literate team and a pragmatic, evidence-based approach, we intend to help our clients answer them.