From ENDC to SNDC: What Indonesian Companies Must Do Now

From ENDC to SNDC: What Indonesian Companies Must Do Now

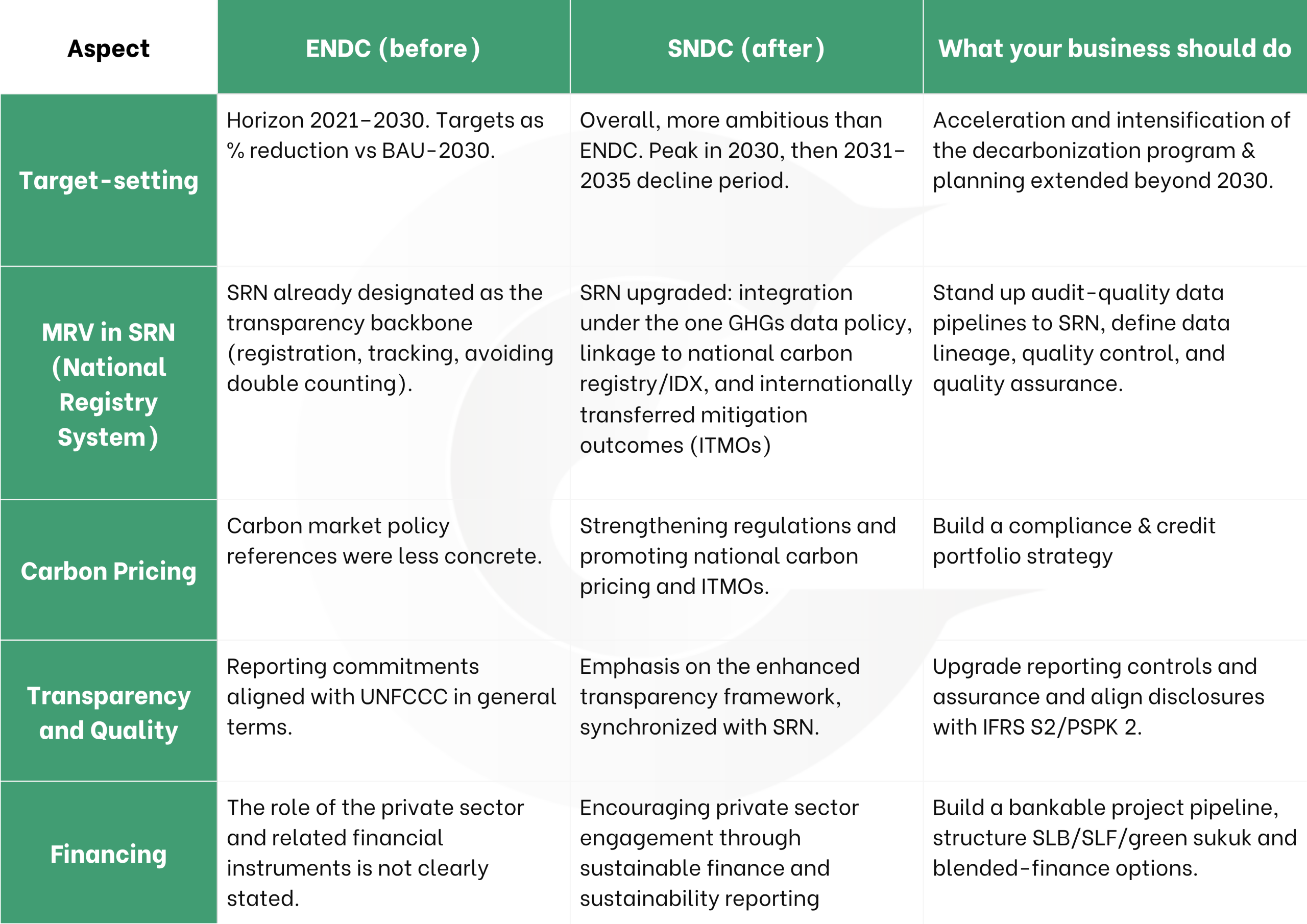

CarbonAccounting.ID welcomes Indonesia’s submission of its Second Nationally Determined Contribution (SNDC) to the UNFCCC at the end of October 2025. Beyond a diplomatic milestone, the SNDC reads like an operating brief for the real economy. It sets clearer signals, sharper timelines, and tighter expectations that will shape board agendas, capital allocation, and disclosure practices across sectors. From our vantage point working with enterprises and public agencies, five shifts stand out for businesses.

First, the SNDC raises the bar on ambition. It signals a 2030 emissions peak followed by a 2031-2035 decline, effectively extending the corporate planning horizon well beyond 2030. For companies, this is not a distant aspiration but a planning constraint: front-load abatement now, or face a steeper and pricier curve later. In practice, that means accelerating energy efficiency, electrifying processes and fleets, tightening fugitive emissions control, and scheduling fuel switching and process changes early enough to influence the 2030 peak and the 2031-2035 glide path.

Second, the SNDC upgrades the National Registry System (SRN) as the backbone of transparency, integrated with the One GHGs Data Policy, connected to the national carbon registry and the IDX, and designed to be ITMOs-ready. The corporate translation is straightforward: build audit-quality data pipelines. That includes documented data lineage, strong quality control and quality assurance, and system governance that can withstand external assurance and regulator scrutiny. If your emissions ledger cannot flow cleanly into SRN, it will slow financing and complicate compliance.

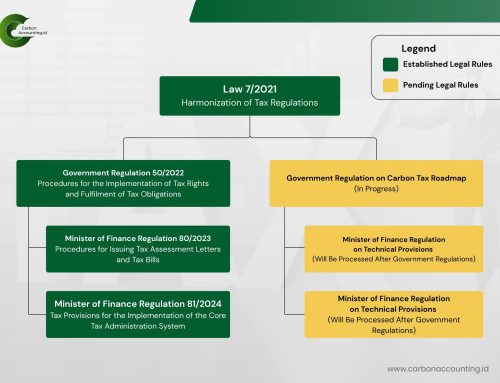

Third, carbon pricing moves from concept to practice. The SNDC emphasizes stronger regulations and the promotion of national carbon pricing alongside the use of internationally transferred mitigation outcomes (ITMOs). Companies should put in place a compliance strategy and a credit portfolio approach, covering allowances, levies or result-based payments, and high-integrity credits, underpinned by clear claims governance and controls for corresponding adjustments. Treat this as treasury plus sustainability: quantify exposures, set procurement and risk limits, and integrate carbon cost curves into investment decisions.

Fourth, the SNDC reinforces an Enhanced Transparency Framework synchronized with SRN. This raises expectations for reporting controls and independent assurance, and it aligns naturally with capital-market standards such as IFRS S2/PSPK 2. Businesses should close gaps in governance, data architecture, and internal control over sustainability reporting, so climate metrics are as decision-useful and auditable as financials. Boards will want clear escalation paths, documented methodologies, and repeatable processes that survive auditor challenge.

Fifth, the SNDC is an invitation to finance the transition. It encourages private-sector involvement through sustainable finance and sustainability reporting, opening room for sustainability-linked bonds (SLB), sustainability-linked finance (SLF), green sukuk, and blended-finance structures. To seize this, companies need bankable project pipelines, with quantified abatement, credible KPIs/SPTs, and MRV that investors trust. CarbonAccounting.ID stands ready to help organizations connect these dots: from strategy and inventories to SRN-grade data, to financing structures that reward real-world decarbonization.