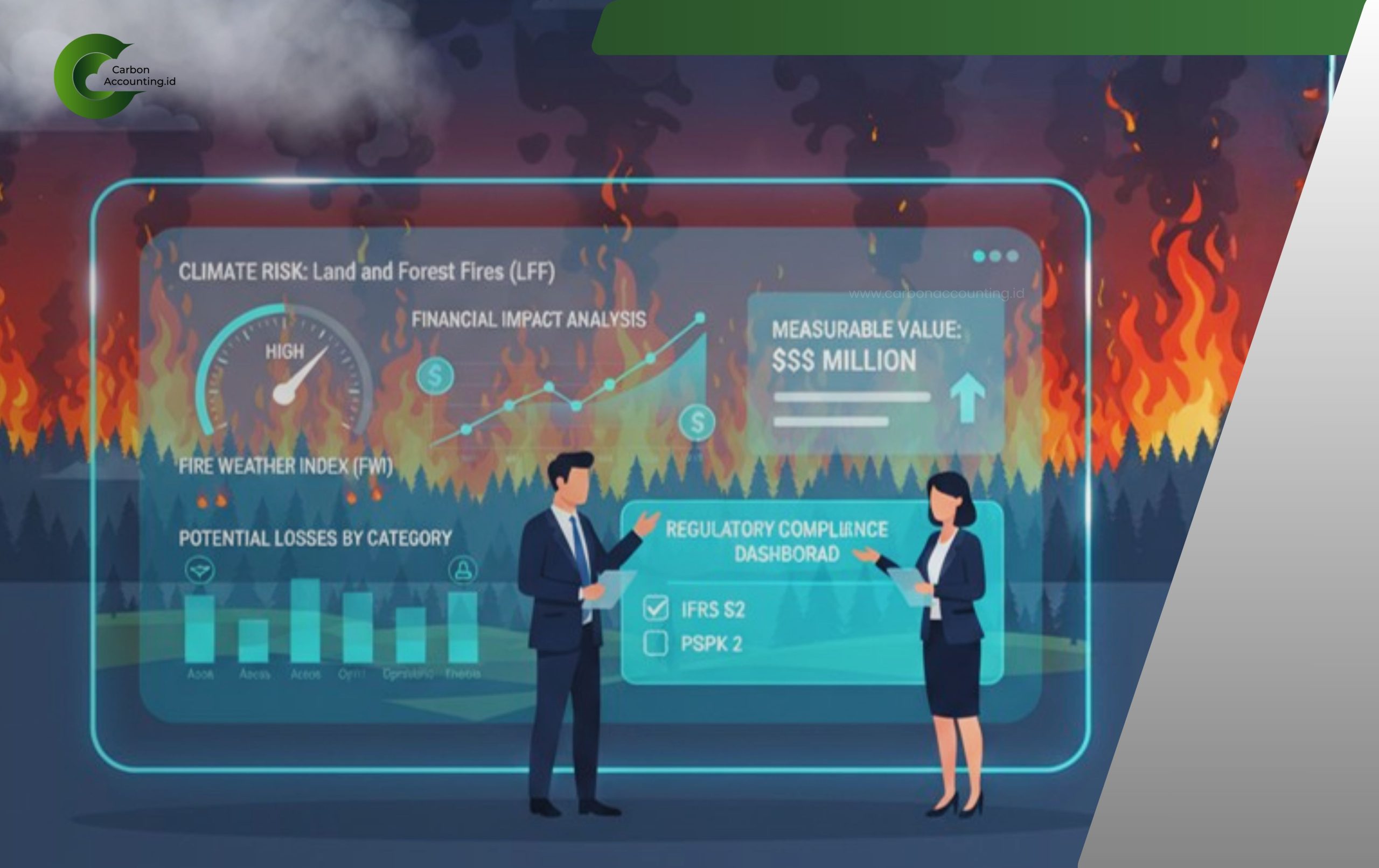

Meeting IFRS S2 and PSPK 2: Turning Forest Fire Risks into Financial Insights

Meeting IFRS S2 and PSPK 2: Turning Forest Fire Risks into Financial Insights

The global shift toward climate-aligned financial reporting has brought new obligations for businesses in Indonesia. Under IFRS S2 and its local adoption through PSPK 2, companies must disclose climate-related risks that can materially affect their finances. Among the most pressing of these risks in Indonesia is forest and land fires (Karhutla). Despite decades of government and corporate efforts at prevention, the danger remains high, particularly during El Niño cycles. Historical records underscore the magnitude: 2.61 million hectares of land burned in 2015, 1.65 million hectares in 2019, and 1.16 million hectares as recently as 2023.

The consequences of these fires extend far beyond scorched landscapes. For society, Karhutla triggers severe health crises, disrupts regional economies, and undermines food security. For businesses, the toll is multifaceted: direct damage to assets, productivity declines, ballooning firefighting expenditures, and heightened exposure to legal liabilities. Reputational harm often follows, complicating relationships with stakeholders and regulators. Most critically, sustained fire risk can deter investment, threatening both profitability and long-term resilience.

At CarbonAccounting.ID, we believe these risks are not merely environmental, they are financially material. That is why we provide specialized services in forest and land fire risk modelling and calculation. Our approach is anchored in the Fire Weather Index (FWI), a globally recognized system that integrates meteorological data with climate models and scenario analysis. By applying this tool to a client’s specific operational areas and assets, we enable companies to produce precise, defensible disclosures in line with IFRS S2 and PSPK 2.

This service acts as a financial early warning system. Instead of viewing fire risk as an unpredictable disaster, companies can now translate it into measurable figures that inform strategic decisions. The result is a stronger capacity to anticipate losses, adapt operational strategies, and allocate resources effectively. In practice, this means businesses can reduce their vulnerability while enhancing transparency to regulators, investors, and global markets.

Ultimately, fire risk disclosure is not only about compliance, it is about competitiveness. By leveraging CarbonAccounting.ID’s modelling services, businesses can safeguard their assets, elevate their credibility, and expand access to sustainable finance. In a world where investors increasingly demand clarity on climate risks, Indonesian companies that get ahead of Karhutla disclosures will stand apart as leaders in resilience and responsibility.