Turning IFRS S2 and PSPK 2 into Action: Scenario-Based Coastal-Risk Insights for Indonesia

Turning IFRS S2 and PSPK 2 into Action: Scenario-Based Coastal-Risk Insights for Indonesia

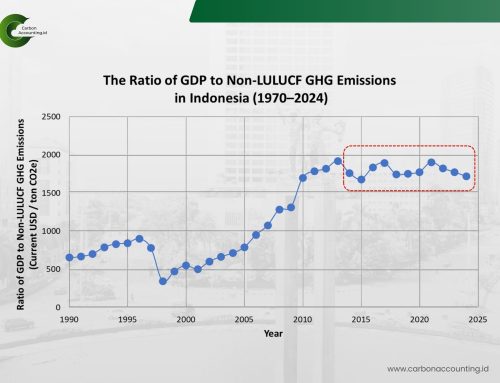

The new era of climate transparency is arriving fast. IFRS S2: Climate-related Disclosures, adopted in Indonesia through PSPK 2, will apply from January 1, 2027, and it raises the bar for how companies communicate climate-related risks and opportunities. The goal is clear: deliver decision-useful information to investors and other stakeholders, not just boilerplate. For businesses operating in Indonesia’s diverse geographies, that means moving beyond generic narratives to credible, location-specific evidence.

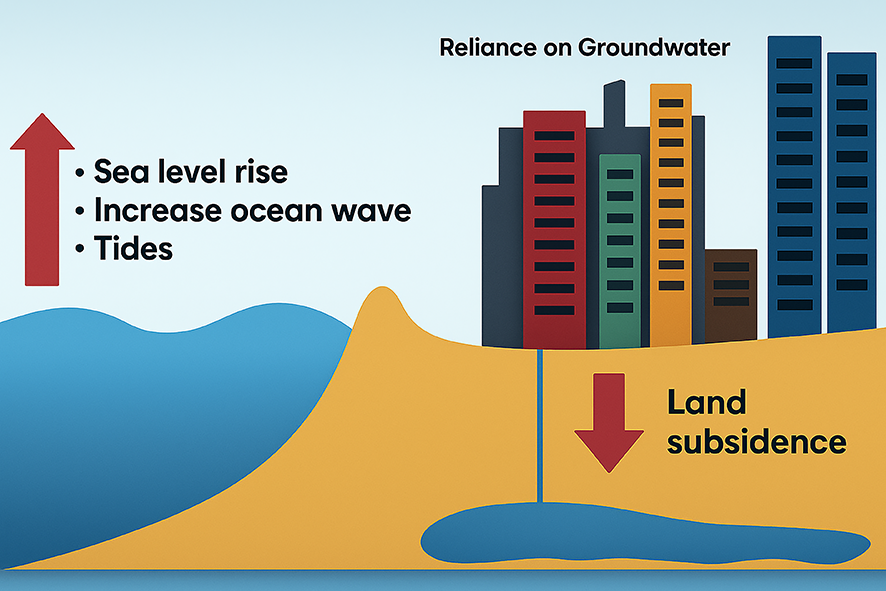

Among the most material items in IFRS S2 is physical risk. With Indonesia possessing the world’s second-longest coastline, integrated coastal risk is not a distant abstraction but a boardroom priority. This risk arises from the combined effects of land subsidence, sea-level rise, changing wave patterns, and shifting tidal patterns: factors that can turn today’s productive coastal assets into tomorrow’s inundation zones. Companies with ports, industrial estates, tourism assets, or logistics links along the coast need to quantify these exposures with rigor.

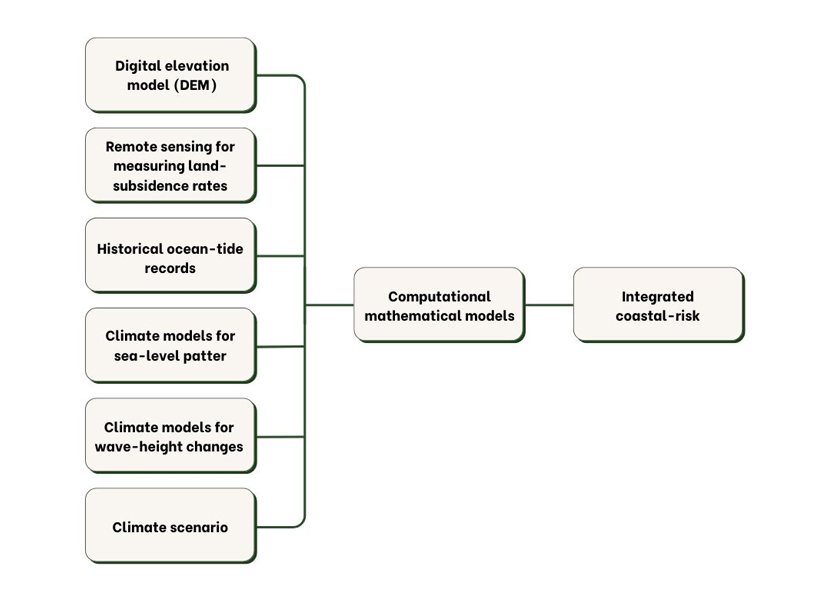

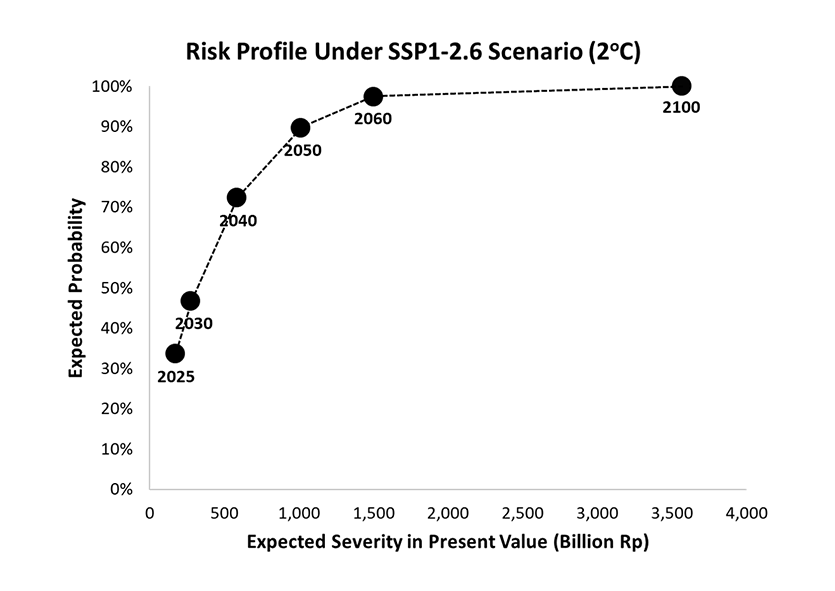

To meet that need, CarbonAccounting.id have developed an integrated coastal-risk analysis designed expressly for corporate disclosure and decision-making. Our approach fuses geospatial datasets, remote-sensing time series, in-situ field observations, and climate-model projections within a computational modelling framework. The result is a dynamic, spatially explicit view of hazard probability and impact severity under multiple climate scenarios, precisely the kind of evidence IFRS S2 and PSPK 2 expect, and the level of fidelity executives need for capital planning.

This level of analysis unlocks value beyond compliance. By translating scenario outputs into practical indicators, such as expected inundation depth, affected floor area, asset downtime, and potential supply-chain disruption. Companies can prioritize site-level mitigation, redesign critical infrastructure, adjust insurance strategies, and stage investments for adaptation. Equally important, robust evidence strengthens engagement with lenders, investors, and regulators, reducing uncertainty and improving the cost of capital.

In short, IFRS S2 and PSPK 2 set the disclosure mandate and our integrated coastal-risk analytics help companies act on it. By pairing credible science with decision-ready metrics, businesses can report confidently, plan proactively, and invest wisely. The payoff is resilience: assets that remain productive, communities that stay protected, and climate strategies that move from paper to performance.