Neoclassical to Net Zero: A Production-Options Framework for Climate Neutrality

We at the Ametis Institute’s Sustainable Economics Division, working with colleagues at the Adam Smith Business School, University of Glasgow, and the Department of Economics at the London School of Economics, have released a new scientific paper, “Production Function as a Set of Discrete Options: Neoclassical, Net Zero, and Climate Neutrality”. The study, openly accessible on SSRN and RePEc, sets out our formal approach to how mainstream economic reasoning intersects with net-zero and climate-neutrality goals.

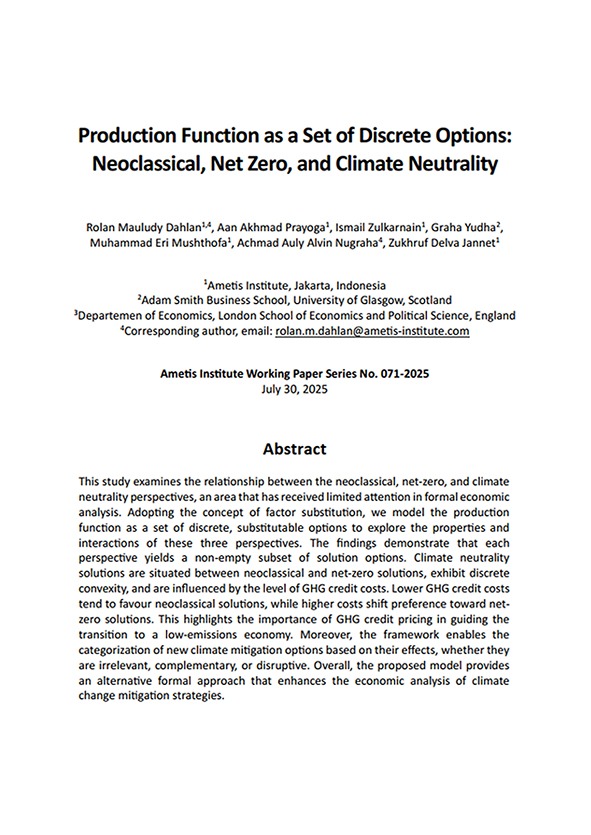

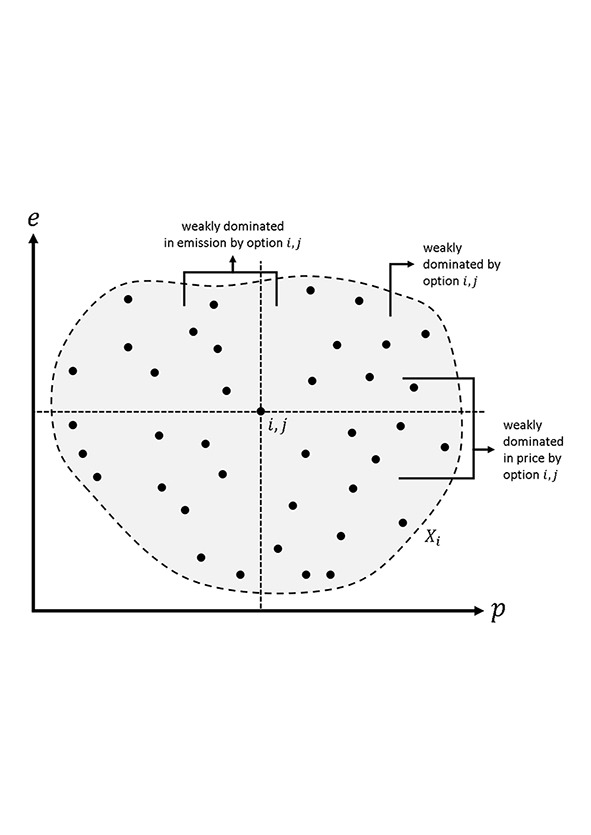

Our starting point is deliberately simple: treat a firm’s production function as a menu of discrete, substitutable options. By doing so, we place neoclassical, net-zero, and climate-neutral perspectives on the same analytical map and examine how they relate. In this framing, climate-neutral choices sit between neoclassical and net-zero options, showing how assumptions about emissions, abatement, and technology translate into distinct yet comparable pathways for producers.

Methodologically, we formalize these options so managers and analysts can compare routes on common economic terms, costs, outputs, and constraints, while explicitly embedding emissions and abatement decisions. This structure makes it straightforward to test sensitivities (energy prices, technology learning curves, policy shocks) and to see when incremental improvements suffice and when a step-change in technology is warranted.

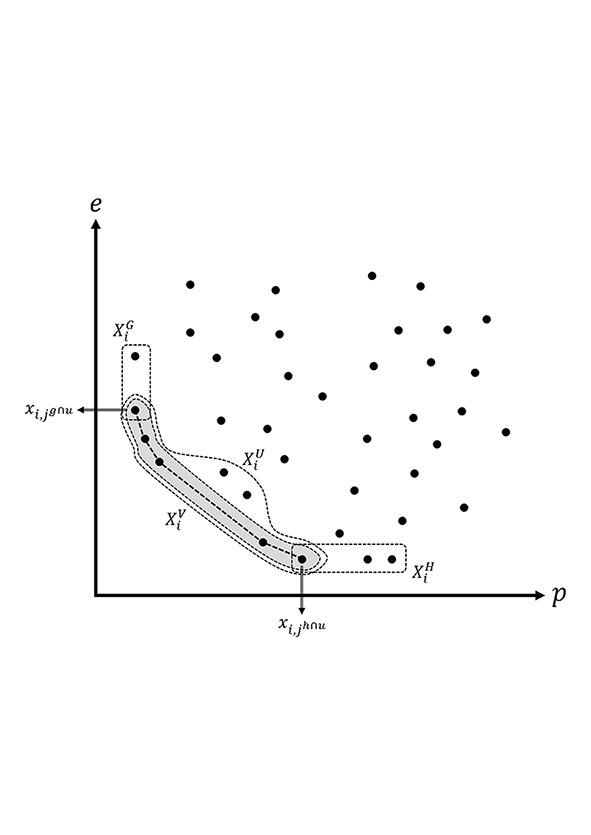

One headline result stands out: the price of GHG credits and offsets powerfully steers the economy’s trajectory. When those costs are low, outcomes tilt toward traditional (neoclassical) configurations. As prices rise, preferences shift toward net-zero solutions. For policymakers and market designers, the message is clear, pricing architecture is not merely fiscal plumbing, it actively shapes firms’ technology and investment choices.

For businesses, our value proposition is practical. We offer a decision-ready framework to evaluate decarbonization options, whether to invest in abatement technologies, purchase credits, or redesign processes, and to judge whether new mitigation measures are irrelevant, complementary, or disruptive to existing strategies. By translating climate goals into a tractable set of production choices, we aim to enrich boardroom and investor discussions on delivering climate mitigation while preserving competitiveness.

Neoclassical to Net Zero: A Production-Options Framework for Climate Neutrality

We at the Ametis Institute’s Sustainable Economics Division, working with colleagues at the Adam Smith Business School, University of Glasgow, and the Department of Economics at the London School of Economics, have released a new scientific paper, “Production Function as a Set of Discrete Options: Neoclassical, Net Zero, and Climate Neutrality”. The study, openly accessible on SSRN and RePEc, sets out our formal approach to how mainstream economic reasoning intersects with net-zero and climate-neutrality goals.

Our starting point is deliberately simple: treat a firm’s production function as a menu of discrete, substitutable options. By doing so, we place neoclassical, net-zero, and climate-neutral perspectives on the same analytical map and examine how they relate. In this framing, climate-neutral choices sit between neoclassical and net-zero options, showing how assumptions about emissions, abatement, and technology translate into distinct yet comparable pathways for producers.

Methodologically, we formalize these options so managers and analysts can compare routes on common economic terms, costs, outputs, and constraints, while explicitly embedding emissions and abatement decisions. This structure makes it straightforward to test sensitivities (energy prices, technology learning curves, policy shocks) and to see when incremental improvements suffice and when a step-change in technology is warranted.

One headline result stands out: the price of GHG credits and offsets powerfully steers the economy’s trajectory. When those costs are low, outcomes tilt toward traditional (neoclassical) configurations. As prices rise, preferences shift toward net-zero solutions. For policymakers and market designers, the message is clear, pricing architecture is not merely fiscal plumbing, it actively shapes firms’ technology and investment choices.

For businesses, our value proposition is practical. We offer a decision-ready framework to evaluate decarbonization options, whether to invest in abatement technologies, purchase credits, or redesign processes, and to judge whether new mitigation measures are irrelevant, complementary, or disruptive to existing strategies. By translating climate goals into a tractable set of production choices, we aim to enrich boardroom and investor discussions on delivering climate mitigation while preserving competitiveness.