Financing Jakarta’s Giant Sea Wall Linking Value Creation and Protection for Inclusive Climate Adaptation

The Giant Sea Wall (GSW) is a flagship climate-adaptation initiative meant to confront land subsidence and sea-level rise along the North Coast of Java. In its initial phase, the project concentrates on Jakarta, where the physical imperatives are urgent and the financing challenge is formidable, given the scale of capital required. From our vantage point, the central question is how to mobilize funding sustainably while ensuring that the project protects people, places, and economic activity already at risk.

Together with colleagues from Sebelas Maret University and the University of Glasgow (Scotland), we have published a paper titled “Innovative Climate Adaptation Financing: A Study of the Giant Sea Wall Jakarta as a Model for Sustainability and Social Inclusion.” The study sets out a structured framework to design financing instruments for GSW, responding to the project’s diverse risks, timelines, and outcomes. Our goal is to translate complex financial architecture into a practical roadmap that policy makers and investors can implement. Dr. Anto Prabowo, the research coordinator, presented this study at the Sebelas Maret International Conference on Digital Economy (SMICDE) on September 4, 2025.

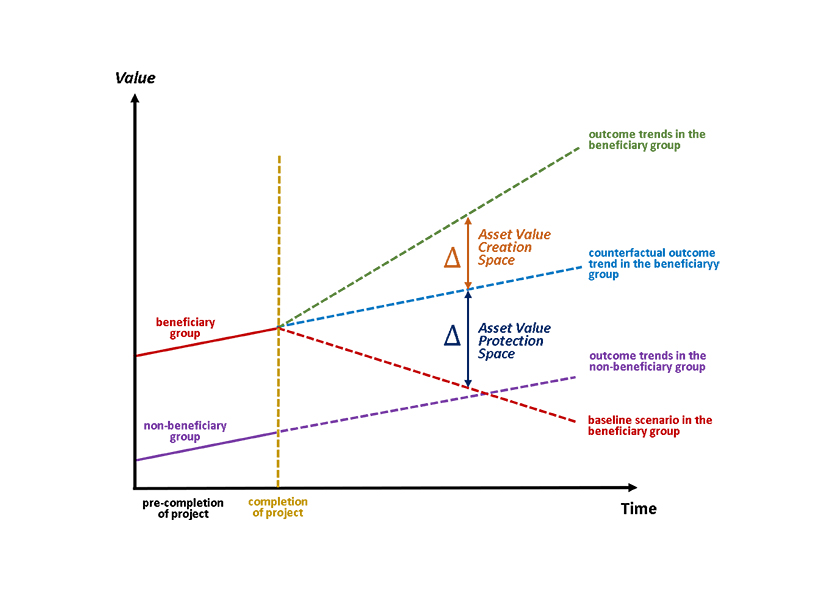

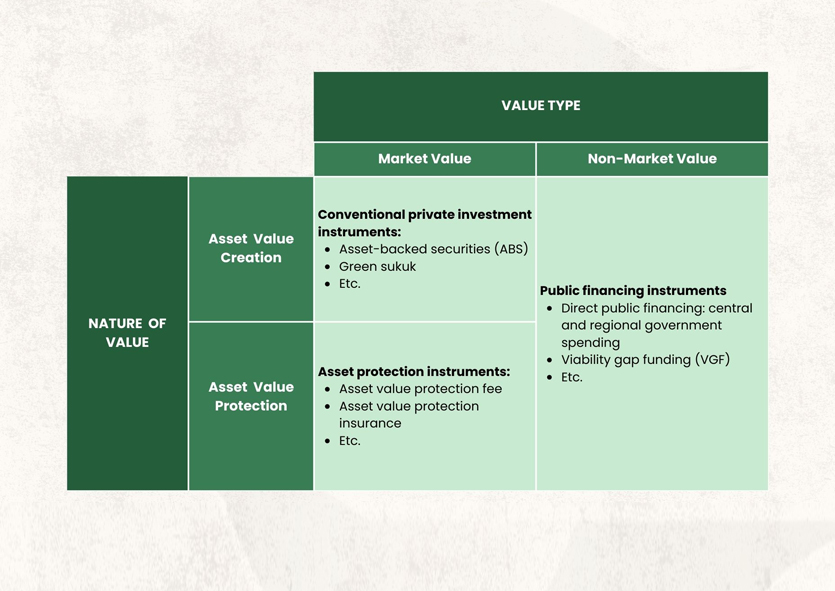

A key insight of the research is to view GSW through two complementary lenses: value creation and value protection. Value creation covers new land, public spaces, and economic activity that the project can unlock. Value protection focuses on safeguarding existing assets (homes, infrastructure, and livelihoods) against worsening coastal hazards. Building on and extending the Yoshino and Pontines (2015) model, we propose matching instruments to each segment of the project according to the nature and type of value at stake.

In operational terms, this means assembling instrument “stacks” that combine conventional private-investment tools with asset-protection mechanisms and public financing. Depending on the segment, these stacks can include forms of debt and equity, guarantees or insurance-style protections, and fiscal support instruments that de-risk early phases or critical public-good components. By tailoring the mix to each segment’s risk-return profile and social purpose, the financing can remain bankable without losing sight of inclusivity and resilience.

As GSW evolves into a precedent for climate-adaptation finance in developing countries, the path forward must balance fiscal sustainability, social equity, environmental justice, and long-term economic growth. At the Ametis Institute, we remain committed to advancing this evidence-based financing agenda with our academic and policy partners, so that Jakarta’s sea wall becomes not only a line of defense, but a model for resilient and inclusive development.

Financing Jakarta’s Giant Sea Wall Linking Value Creation and Protection for Inclusive Climate Adaptation

The Giant Sea Wall (GSW) is a flagship climate-adaptation initiative meant to confront land subsidence and sea-level rise along the North Coast of Java. In its initial phase, the project concentrates on Jakarta, where the physical imperatives are urgent and the financing challenge is formidable, given the scale of capital required. From our vantage point, the central question is how to mobilize funding sustainably while ensuring that the project protects people, places, and economic activity already at risk.

Together with colleagues from Sebelas Maret University and the University of Glasgow (Scotland), we have published a paper titled “Innovative Climate Adaptation Financing: A Study of the Giant Sea Wall Jakarta as a Model for Sustainability and Social Inclusion.” The study sets out a structured framework to design financing instruments for GSW, responding to the project’s diverse risks, timelines, and outcomes. Our goal is to translate complex financial architecture into a practical roadmap that policy makers and investors can implement. Dr. Anto Prabowo, the research coordinator, presented this study at the Sebelas Maret International Conference on Digital Economy (SMICDE) on September 4, 2025.

A key insight of the research is to view GSW through two complementary lenses: value creation and value protection. Value creation covers new land, public spaces, and economic activity that the project can unlock. Value protection focuses on safeguarding existing assets (homes, infrastructure, and livelihoods) against worsening coastal hazards. Building on and extending the Yoshino and Pontines (2015) model, we propose matching instruments to each segment of the project according to the nature and type of value at stake.

In operational terms, this means assembling instrument “stacks” that combine conventional private-investment tools with asset-protection mechanisms and public financing. Depending on the segment, these stacks can include forms of debt and equity, guarantees or insurance-style protections, and fiscal support instruments that de-risk early phases or critical public-good components. By tailoring the mix to each segment’s risk-return profile and social purpose, the financing can remain bankable without losing sight of inclusivity and resilience.

As GSW evolves into a precedent for climate-adaptation finance in developing countries, the path forward must balance fiscal sustainability, social equity, environmental justice, and long-term economic growth. At the Ametis Institute, we remain committed to advancing this evidence-based financing agenda with our academic and policy partners, so that Jakarta’s sea wall becomes not only a line of defense, but a model for resilient and inclusive development.